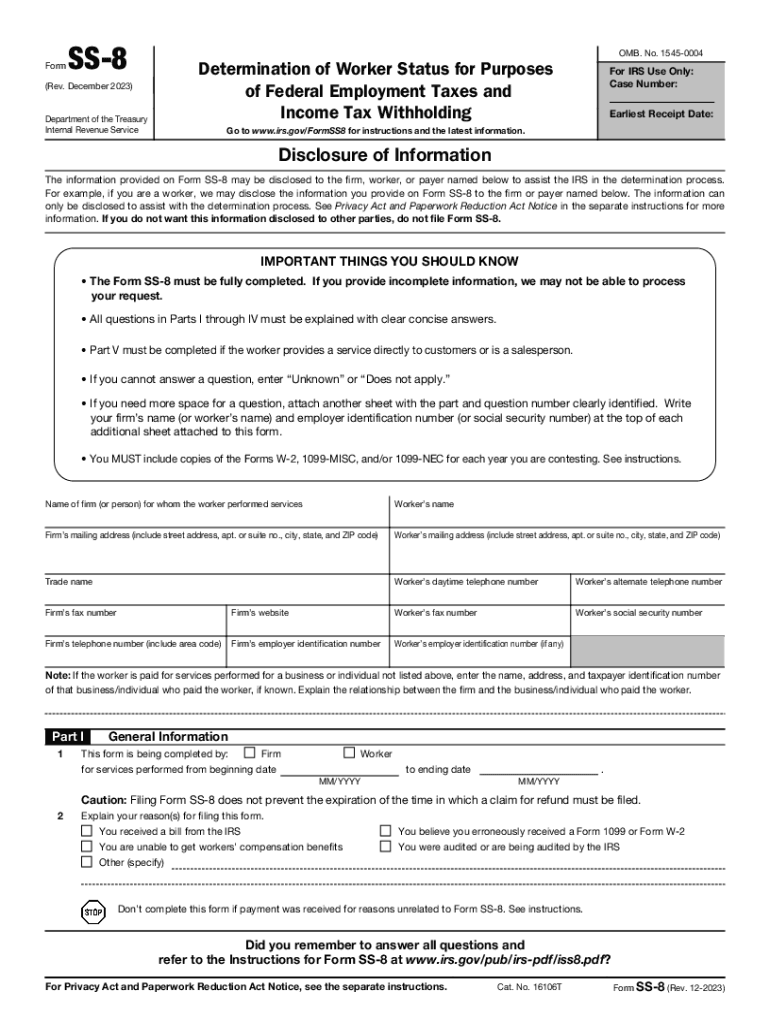

IRS SS-8 2023-2026 free printable template

Instructions and Help about IRS SS-8

How to edit IRS SS-8

How to fill out IRS SS-8

Latest updates to IRS SS-8

All You Need to Know About IRS SS-8

What is IRS SS-8?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS SS-8

What should I do if I made a mistake on my IRS SS-8 form?

If you discover an error on your IRS SS-8 form after submission, it is crucial to file an amended version promptly. You should prepare a new IRS SS-8 and clearly mark it as 'amended.' Include a note explaining the reason for the correction. It's important to retain copies of both the original and amended forms for your records.

How can I check the status of my submitted IRS SS-8?

To track the status of your IRS SS-8 form, you can call the IRS directly or check online if you e-filed the form. Keep in mind that it may take several weeks for your submission to be processed. If you encounter a common e-file rejection code, you will need to rectify the issue and resubmit the form.

Can I use an e-signature on my IRS SS-8 form?

Yes, e-signatures are generally accepted for IRS SS-8 filings when submitted electronically. However, you should ensure that you comply with all IRS guidelines regarding electronic signatures. Retaining a copy of your signed form is important for your records and future reference.

What should I do if I receive a notice from the IRS after filing IRS SS-8?

If you receive a notice from the IRS regarding your IRS SS-8 submission, it is essential to read the notice carefully and respond promptly. Gather any required documentation that supports your case, and follow the instructions provided in the letter to ensure you address any concerns raised by the IRS.

Are there common errors I should watch out for when filing IRS SS-8?

When filing your IRS SS-8, common errors include incorrect taxpayer identification numbers and incomplete addresses. To avoid these mistakes, double-check all the information you enter and ensure that each field is correctly filled out before submission. This can help prevent delays in processing your form.